7 Easy Facts About Pvm Accounting Shown

7 Easy Facts About Pvm Accounting Shown

Blog Article

Unknown Facts About Pvm Accounting

Table of ContentsThe 5-Second Trick For Pvm AccountingIndicators on Pvm Accounting You Need To KnowAll about Pvm AccountingThe Pvm Accounting IdeasThe Ultimate Guide To Pvm AccountingLittle Known Questions About Pvm Accounting.

Look after and take care of the creation and approval of all project-related payments to consumers to foster excellent communication and avoid problems. construction taxes. Ensure that proper records and documentation are submitted to and are updated with the internal revenue service. Make sure that the audit process follows the law. Apply needed building and construction accountancy criteria and procedures to the recording and reporting of construction task.Communicate with different funding firms (i.e. Title Company, Escrow Firm) pertaining to the pay application process and requirements required for repayment. Help with applying and preserving internal economic controls and procedures.

The above statements are meant to explain the general nature and level of job being carried out by people appointed to this classification. They are not to be taken as an exhaustive checklist of duties, obligations, and skills needed. Workers might be called for to carry out duties beyond their regular obligations every now and then, as required.

The 25-Second Trick For Pvm Accounting

You will certainly assist sustain the Accel team to ensure delivery of effective in a timely manner, on budget plan, projects. Accel is seeking a Building and construction Accounting professional for the Chicago Workplace. The Building and construction Accounting professional does a variety of bookkeeping, insurance coverage compliance, and task management. Functions both separately and within certain divisions to keep monetary documents and ensure that all documents are maintained present.

Principal tasks include, but are not limited to, handling all accounting functions of the firm in a timely and precise fashion and providing reports and routines to the business's certified public accountant Firm in the prep work of all monetary statements. Ensures that all audit treatments and functions are managed accurately. In charge of all economic records, payroll, banking and day-to-day operation of the bookkeeping function.

Prepares bi-weekly trial equilibrium records. Works with Project Managers to prepare and post all monthly billings. Processes and problems all accounts payable and subcontractor payments. Creates monthly wrap-ups for Employees Payment and General Responsibility insurance costs. Generates regular monthly Job Price to Date reports and dealing with PMs to integrate with Task Managers' allocate each task.

Excitement About Pvm Accounting

Efficiency in Sage 300 Construction and Realty (previously Sage Timberline Office) and Procore building monitoring software program an and also. https://pvmaccount1ng.start.page. Must also excel in various other computer system software program systems for the prep work of reports, spread sheets and other accountancy analysis that might be called for by management. construction taxes. Should possess solid business abilities and ability to focus on

They are the financial custodians that make sure that building jobs stay on budget plan, follow tax obligation guidelines, and preserve monetary transparency. Building and construction accountants are not just number crunchers; they are strategic partners in the building process. Their main function is to take care of the monetary facets of construction tasks, guaranteeing that sources are alloted effectively and monetary threats are decreased.

Getting The Pvm Accounting To Work

By keeping a tight hold on task funds, accounting professionals aid avoid overspending and monetary setbacks. Budgeting is a foundation of effective building tasks, and construction accountants are critical in this respect.

Construction accounting professionals are well-versed in these laws and make sure that the task complies with all tax obligation needs. To succeed in the role of a building accountant, people require a strong instructional structure in accounting and money.

Furthermore, qualifications such as Licensed Public Accounting Professional (CPA) or Licensed Building And Construction Sector Financial Specialist (CCIFP) are highly regarded in the sector. Building tasks often entail limited target dates, transforming regulations, and unexpected expenditures.

Excitement About Pvm Accounting

Specialist certifications like CPA or CCIFP are also very advised to show expertise in building bookkeeping. Ans: Building and construction accounting professionals create and keep track of budgets, identifying cost-saving chances and making certain that the job stays within budget. They also track expenditures and forecast economic requirements to stop overspending. Ans: Yes, construction accountants manage tax obligation compliance for construction jobs.

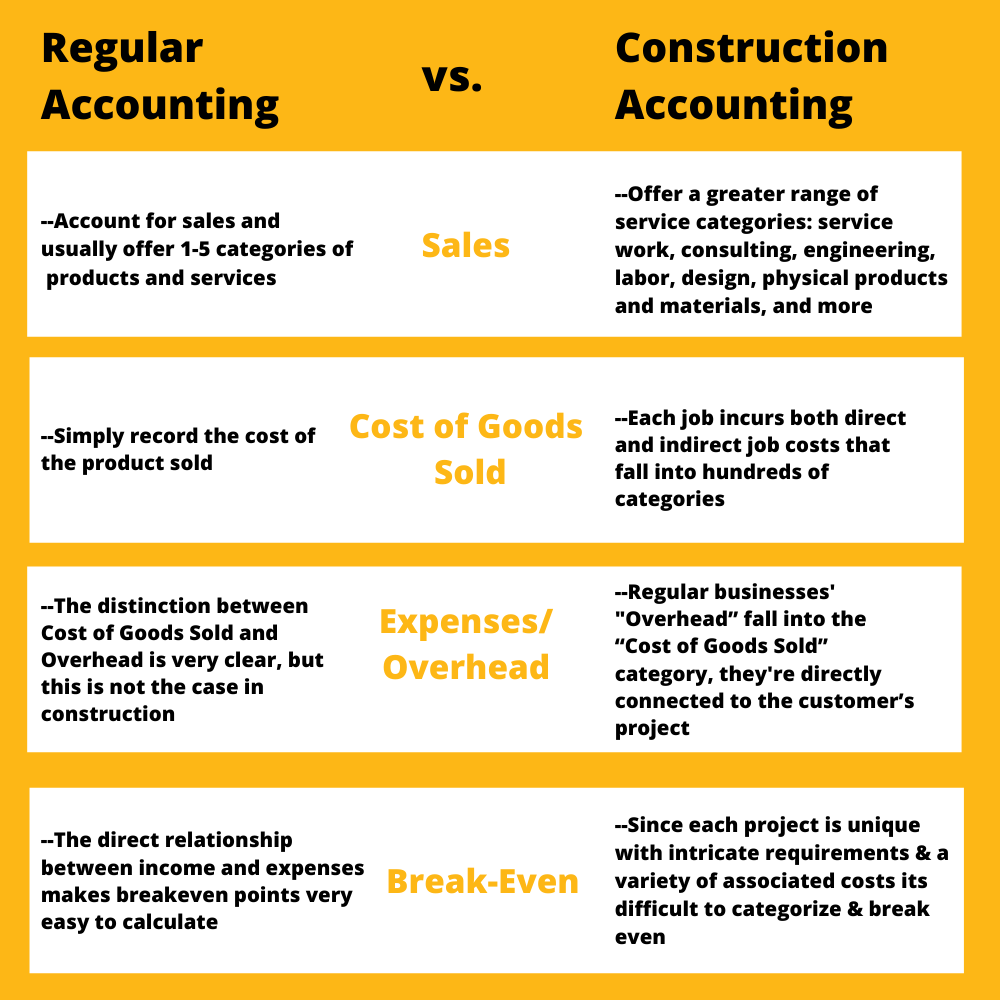

Introduction to Construction Accounting By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building firms have to make tough selections among several financial options, like bidding on one job over an additional, picking funding for products or equipment, or setting a project's profit margin. Building and construction is a notoriously unstable market with a high failing rate, slow time to repayment, and inconsistent money circulation.

Common manufacturerConstruction business Process-based. Manufacturing involves repeated procedures with easily identifiable expenses. Project-based. Production calls for various procedures, products, and equipment with varying costs. Fixed place. Manufacturing or production occurs in a solitary (or numerous) regulated places. Decentralized. Each task occurs in a new place with differing website problems and unique obstacles.

10 Easy Facts About Pvm Accounting Explained

Long-lasting partnerships with suppliers alleviate settlements and boost efficiency. Inconsistent. Regular use of different specialty professionals and distributors impacts effectiveness click reference and cash flow. No retainage. Repayment gets here completely or with normal repayments for the complete contract amount. Retainage. Some section of payment may be withheld up until project completion also when the specialist's job is ended up.

While traditional manufacturers have the benefit of controlled atmospheres and maximized production procedures, construction business must continuously adjust to each brand-new task. Even somewhat repeatable tasks require alterations due to site conditions and various other factors.

Report this page